The transfer of ownership for bearer bonds is easy, as it only requires the physical delivery of the bond, simplifying the process for buyers and sellers. Bearer bonds, which no longer exist in the U.S., are used to secure debt financing. Whoever held the bond certificate was entitled to its value and coupon payments at maturity.

Are there any alternatives to bearer bonds that provide similar benefits?

In the modern age, bearer bonds are typically linked to clandestine financial activity. For example, an individual might transfer some of their wealth into bearer bonds in an attempt to avoid reporting it to the IRS. And, the inability to redeem these bonds in the United States makes the situation even messier.

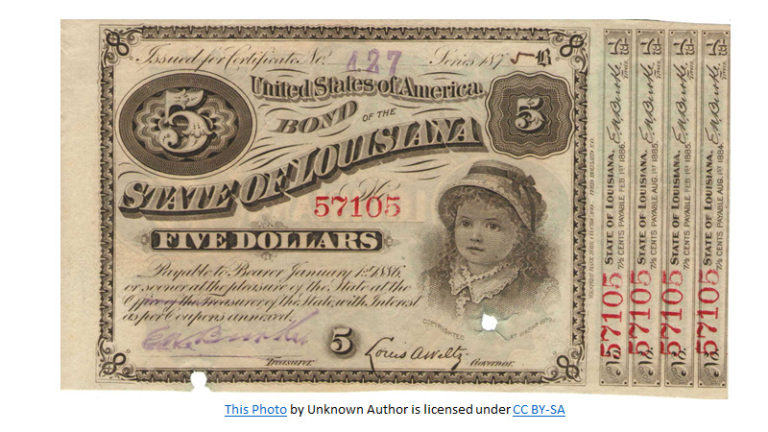

- A bearer instrument, or bearer bond, is a type of fixed-income security in which no ownership information is recorded and the security is issued in physical form to the purchaser.

- There are no records regarding when the bond is bought and sold, and there are no records regarding who is receiving the interest payments.

- Obviously, this system is highly automated, or it would collapse.

- This gives the holder a certain level of anonymity, as the bond does not contain any personal information linking it to the owner.

- These bonds are considered to be relatively secure investments, given the backing of the issuing government.

Why You Should Start Investing Right Now

A new 2010 U.S. law was passed to relieve banks and brokerages from responsibility for redeeming old bearer bonds. The risks are not limited to individual investors and criminals; financial institutions themselves can be vulnerable. Banks and brokerage firms that handle bearer bonds must implement stringent security measures to prevent theft and fraud. This often involves secure storage facilities, rigorous verification processes, and comprehensive auditing procedures.

Chip Stapleton: Taxes, Fees & Commissions To Consider With Annuities

Most jurisdictions now require corporations to maintain records of ownership or transfers of bond holdings and do not permit bond certificates to be issued to the bearer. A bearer bond or bearer note is a bond or debt security issued by a government or a business entity such as a corporation. As a bearer instrument, it differs from the more common types of investment securities in that it is unregistered—no records are kept of the owner, or the transactions involving ownership. Whoever physically holds the paper on which the bond is issued is the presumptive owner of the instrument.

Studying the bond and learning more about the issuer of the bond will help you determine the value of your bearer bond. In theory, bearer bonds function the same way as any other fixed-income bond. However, in practice, they require much more interaction via physical transaction. They are bearer bonds value an interesting type of security that offer as much convenience as they receive scrutiny. To collect payments, bondholders remove a coupon and submit it to the bond issuer (or “clip coupons”). Theft and forgery are tempting because bearer bonds are essentially one step away from cash.

In book-entry bonds, the investor gets receipts instead of certificates. Investors also get accounts handled by financial institutions. They are able to receive their interest payments through these accounts. A bearer bond is a fixed-income security that is owned by the holder, or bearer, rather than by a registered owner. The coupons for interest payments are physically attached to the security. The bondholder is required to submit the coupons to a bank or government treasury for payment and then redeem the physical certificate when the bond reaches the maturity date.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

An issuer of a bearer form security keeps no record of who owns the security at any given point in time. This means that the security is traded without any record of ownership, so physical possession of the security is the sole evidence of ownership. Thus, whoever produces the bearer certificate is assumed to be the owner of the security and can collect dividends and interest payments tied to the security. Unlike other types of bonds, bearer bonds do not have a record of ownership.