For example, companies might use one time period assumption for their income statement and another time period assumption for the other financial statements. Another connection to the time period principle, is the going concern principle. The going concern principle states that businesses should assume they will continue to operate and exist in the foreseeable future, and not liquidate.

1 Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements

There also does not have to be a correlation between when cash is collected and when revenue is recognized. Even though the customer has not yet paid cash, there is a reasonable expectation that the customer will pay in the future. Since the company has provided the service, it would recognize the revenue as earned, even though cash has yet to be collected. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Businesses all around the world carry out this process as part of their normal operations. In carrying out these steps, the timing and rate at which transactions are recorded and subsequently reported in the financial statements are determined by the accepted accounting principles used by the company. The accounting guideline that allows the accountant to divide up the complex, ongoing activities of a business into periods of a year, quarter, month, week, etc. The precise time period covered is included in the heading of the income statement, statement of cash flows, and the statement of stockholders’ equity. Companies might use just one time period assumption for all their income statements or change the time frame depending on what information is being presented.

Since outside financial statement users want timely financial information, the time period assumption allows us to prepare financial statements on a monthly, quarterly, and annually basis. A time period assumption in accounting means that a company uses financial reporting based on its own chosen periods. It depends on what information you are trying to represent with your company’s revenue and expenses.

In financial terms, a time 50+ ways to increase website traffic period is often referred to as the accounting year, or accounting and reporting time periods. These periods can be quarterly, half yearly, annually, or any other interval depending on the business’ and owners’ preference. The time period assumption states that a company can present useful information in shorter time periods, such as years, quarters, or months. The information is broken into time frames to make comparisons and evaluations easier.

What is periodicity in accounting?

Even though Lynn feels the equipment is worth $60,000, she may only record the cost she paid for the equipment of $40,000. The customer did not pay cash for the service at that time and was billed for the service, paying at a later date. When should Lynn recognize the revenue, on August 10 or at the later payment date? She provided the service to the customer, and there is a reasonable expectation that the customer will pay at the later date. The accounting period needs to be consistent from one period to the next, we cannot change the period so often as it will impact the comparative report.

Without a dollar amount, it would be impossible to record information in the financial records. It also would leave stakeholders unable to make financial decisions, because there is no comparability measurement between companies. This concept ignores any change in the purchasing power of the dollar due to inflation. So it is very important for the company to publish a reliable financial report to let them know about company performance. All related parties need to know company performance and financial position to make proper decisions. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

The time period principle

Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

This might mean allocating costs over more than one accounting or reporting period. The conceptual framework sets the basis for accounting standards set by rule-making bodies that govern how the financial statements are prepared. Here are a few of the principles, assumptions, and concepts that provide guidance in developing GAAP. checking account meaning The procedural part of accounting—recording transactions right through to creating financial statements—is a universal process.

- This means that IFRS interpretations and guidance have fewer detailed components for specific industries as compared to US GAAP guidance.

- It is a very straightforward example, which we try to illustrate the concept of the matching principle.

- You may want to try using one method for all of your financial reporting or only change the time frame when it makes sense, like if there is a significant difference between revenues and expenses during certain months.

- Even though the customer has not yet paid cash, there is a reasonable expectation that the customer will pay in the future.

Tax Cuts and Jobs Act

When you access this website or use any of our mobile applications we may automatically collect information such as standard details and identifiers for statistics or marketing purposes. You can consent to processing for these purposes configuring your preferences below. Please note that some information might still be retained by your browser as it’s required for the site to function.

How much are you saving for retirement each month?

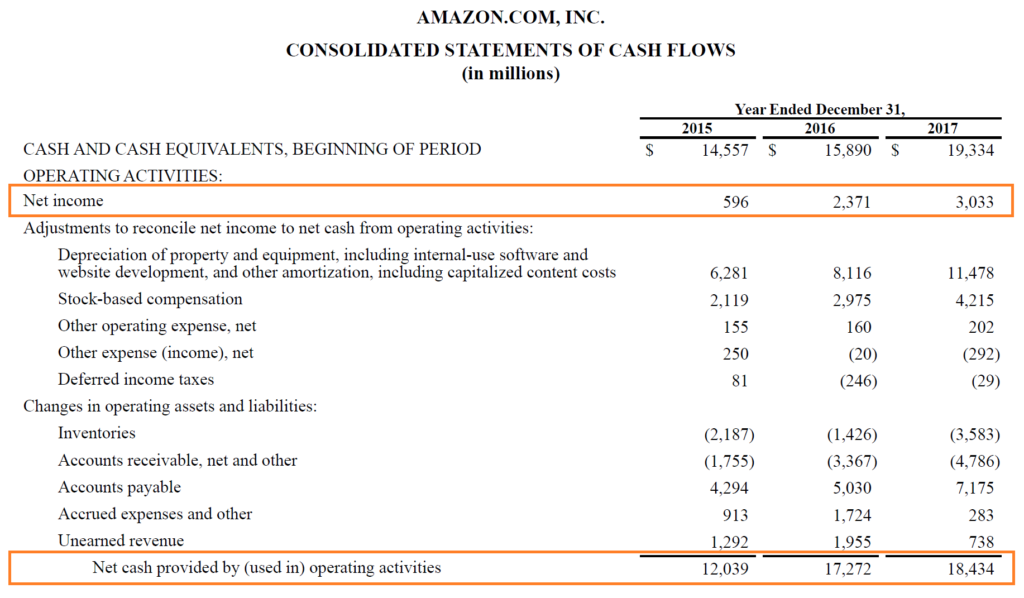

Time period assumption is the period in which businesses divide ongoing business into shorter periods to prepare the financial statements. The business operation will continue for a long time, but accountant needs to prepare financial statements for the management to make a proper and timely decision. Annual reports are usually called the physical year, and any report less than that is called an interim report. Investors and creditors want the most current information possible to base their financial decisions on.

If the business will stay operational in the foreseeable future, the company can continue to recognize these long-term expenses over several time periods. Some red flags that a business may no longer be a going concern are defaults on loans or a sequence of losses. As you learned in Role of Accounting in Society, US-based companies will apply US GAAP as created by the FASB, and most international companies will apply IFRS as created by the International Accounting Standards Board (IASB).

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Another example would be if a business reported both February and March revenues together because their revenues were about the same.

The information will be timely and current and will give a meaningful picture of how the company is operating. Some companies that operate on a global scale may be able to report their financial statements using IFRS. The SEC regulates the financial reporting of companies selling their shares in the United States, whether US GAAP or IFRS are used. The basics of accounting discussed in this chapter are the same under either set of guidelines. The accounting period will reflect the amount of revenue and expense recording within each period.

This would mean that any uncertain or estimated expenses/losses should be recorded, but uncertain or estimated revenues/gains should not. This gives stakeholders a more reliable view of the company’s financial position and does not overstate income. The separate entity concept prescribes that a business may only report activities on financial statements that are specifically related to company operations, not those activities that affect the owner personally. This concept is called the separate entity concept because the business is considered an entity separate and apart from its owner(s).